Do you think the mortgage industry is inclusive or should more be done?

The Association of Mortgage Intermediaries (AMI), along with Aldermore and Virgin Money are looking at these and other questions. They’d like to understand what it’s like to work in our industry and whether people feel included and able to be themselves at work, so they’ve asked Versiti, independent experts in this area, to explore your experiences.

They want to hear from everyone who works in the intermediary sector. Whether you work on your own or in a small or large firm; you’re new to the industry or a veteran; you’re a broker, an administrator, a manager or a director – please take part today, share the survey with your colleagues and make sure that your views are heard.

A report on the findings of the research will be published at the end of September this year. Click here to start the survey now.

The 80s are here again – we’re bringing back our 80% LTV BTL mortgages!

We love giving you what you want. So by popular demand, we’re bringing back our 80% LTV BTL Mortgages.

Break out the boombox and get the party started as you’ll be able to help more landlords make the most of the fast-recovering market. Our 80% LTV BTL products are really useful for clients needing a smaller deposit, enabling portfolio landlords to grow their portfolio quicker.

- No minimum income

- Available for purchase and remortgage

- Speak direct to your underwriter during application

At The Mortgage Lender, we’re all about moving forward. Even when that means going back to a crowd-pleasing 80% LTV.

95% New Build market launch

Skipton Building Society is entering the 95% new build market with the launch of two new products available to the whole market.

New build flats will continue to be limited to 85% LTV; however, shared ownership continues to be an exception where Skipton will allow new build houses and flats up to 95% LTV.

Key Changes for Ipswich

Headline changes

- Background pension funds – we will use 80% of the total fund value for pension that could be drawn should the applicants need to (but are currently not being utilised). We will divide the 80% of the fund value by the term of the mortgage and use that figure as gross income for affordability and LTI calculations.

- We will accept day 1 remortgage on self-build applications where the applicant has owned the land for less than 6 months, subject to the applicants showing as the owners on Land Registry, prior to application.

Self Employed

- Now accepted up to 90% LTV.

- Government Support Loans accepted if no Loans taken in 2021 and can evidence it has not been utilised (monies remained in account).

- For accounts covering 2020 (or April 2021 Tax Calcs) we can use the latest figure if the increase has been less than 20% (if above 20% or accounts do not cover this period then an average of the latest 2 years will be used).

- Self Employed Grants accepted if no grants taken in 2021.

Other

- No payment holidays within the last 3 months.

- Applicants on Furlough no longer accepted.

- 50% of bonus/overtime/commission used. 100% if guaranteed (contract to evidence).

- Consolidating a 2nd charge.

- Debt consolidation up to 75% LTV.

Your hour with the experts! InterBay Commercial’s first-ever Live Chat event

Struggling with a complex commercial case? Need help with a holiday let? It’s time to talk to the experts.

On Wednesday 11 August between 10am and 11am, you’ll be able to speak directly to InterBay Commercial’s Head of Specialist Finance, Emily Machin and Head of Underwriting Operations, Craig Richardson on Live Chat

Whether you need help with a large HMO portfolio, a limited company commercial set up, or you’re taking on your first holiday let case, this could be your chance to get the answers you need. They won’t be able to discuss existing cases.

For discussing complex cases with industry experts… InterBay it!

Average interest rates 50% lower than they were 10 years ago

The equity release market has evolved over the last 10 years and Key’s latest report has highlighted interest rates have halved* dispelling the myths that equity is an expensive lending option.

More than £32.6 billion of property wealth has been released over 20 years helping 557,000 customers and could be a great time to take advantage of these low interest rates by offering equity release as a viable option for your clients.

For more guidance, you can catch the on-demand webinar now for ‘Bringing equity release to life’ which will take you through the types of potential equity release clients you may encounter.

*Data supplied by Key’s Equity Release Revolution report. To read the report in full, visit https://www.keyadvice.co.uk/about/press-release

Our Live webchat is now open Saturdays

We have now opened our live webchat service on a Saturday from 9am – 1pm accessed through OLPC, the only channel available outside core working hours, allowing you greater flexibility to discuss New and Existing business queries

We believe that you should be able to interact with us in a way which is convenient for you. We believe that helping you achieve fast resolutions in a cost-effective way is important.

Making it easier for you to do business with us.

- No need to complete data protection checks: Launching a live chat through Agent Hub means your connection is verified.

- Improves the service you can offer your customers: You no longer need to keep your customer on hold or arrange to call them back whilst you call through to us.

- Multi-Skilled consultants: Our Web Chat consultants are trained in both new and existing business processes.

Thriving through a pandemic.

How a commercial loan brokered by Watts Commercial Finance helped a mother and daughter team realise their dream of independent business premises ownership.

Find out more about how Watts Commercial helped.

Call us today on 03303 110777 or email advice@watts-commercial.co.uk to see how we can help your clients to realise their dream of independent business premises ownership.

R is for Reduced Rates

We’ve recently launched our new product range, featuring reduced rates across the majority of products in both our Standard and Specialist range. With such competitive rates and broad criteria, there’s never been a better time to get in touch with Zephyr. View our new products.

Take look at some cases we’ve recently supported:

- 20 property portfolio remortgage – offer underwritten in 3 days

- First time landlord purchase, with limited credit history – expert underwriter discretion applied 4 bed

- HMO remortgage for joint landlords – existing background portfolio of 103 properties

Limited company purchase with 2 directors – limited credit history assessed and accepted - High value, high-rise property purchase – large loan offered of £975,000 at 65% LTV

- Joint landlord remortgage of standard 3 bed semi – Individual assessment of application

Why not see if your case fits, find your local BTL expert here

Or call 0370 707 1894 – Monday to Friday 9am to 5pm.

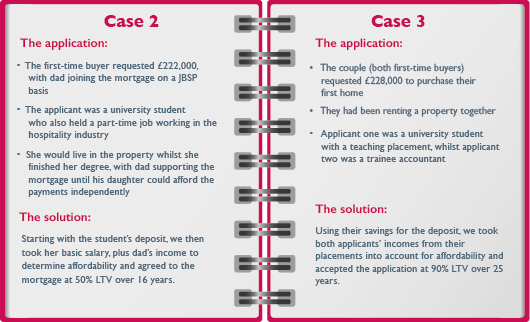

First Time Buyers – Taking a closer look at our niche products

As part of our In Focus update, this month we will be showing you examples of first-time buyer mortgage cases discussed during our daily Mortgage Referral Committee meetings. In a year which has been unkind to first-time buyers, with increasing average house prices which have halted the hopes of many trying to get their feet on the housing ladder, we’re proud to say that we have continued to help many first-time buyers to purchase their properties. And with mortgages available to 95% LTV, there’s plenty of opportunities for first-home hopefuls to become homeowners.

As our FTB focussed month comes to an end, we would like to share some cases with you which have featured first-time buyer applicants who are in further education…

First-Time Buyer Students’ Special

COVID-19 exclusion removal and upgraded Mutual Benefits prize draws!

In light of the successful vaccine roll out and in line with the overall market response, we are delighted to announce that we have removed our COVID-19 exclusion for all applications from 31st July 2021 onwards.

Save your clients months of premiums in our upgraded Mutual Benefits prize draws!

We’ve also made an exciting change to our discretionary Mutual Benefits programme this month.

Every month all our members who have activated their Mutual Benefits are automatically entered into a prize draw and the winner receives a cash prize from us.

What’s changing?

In previous prize draws we’ve selected 1 winner every month, but to improve your clients’ chance of winning we will now select 3 lucky winners of £100 each month.

This could potentially save your clients months worth of premiums or give them the chance to spend it on shopping, a new gadget or simply treating their loved ones.

Learn more about the full range of benefits your clients can access through the programme here.

Get in touch

To learn more about how we can offer extra value for your clients get in touch with our Partnership Support Team by e-mailing sales@britishfriendly.com or give us a ring on 01234 358344 (option 1) and we’ll be happy to help.

Holiday Let Mortgages Q&A

The staycation market is booming – have you tried to book anywhere in the UK this summer??

As a specialist mortgage supplier, we have seen a significant increase in enquiries and applications for Holiday Let mortgages. So to keep you ‘in the know’, here are some common questions & answers that will help you gain more knowledge and source the right mortgage for holiday or short term lets:

Are rates cheaper than BTL rates?

The market is not quite as competitive as BTL yet but rates are dropping, the lowest rate is 3.19% and the highest is 5.49%. As always the rate available will depend on the specific clients’ circumstances. Please call us for up to the minute rates.

What’s the maximum LTV available?

LTV varies up to a maximum of 75%.

What if the client wants to stay in the property?

This is one of the key differences between a standard BTL property and a Holiday Let, some lenders will allow the clients to holiday in the property for up to 60 days per year.

Any experience needed?

In most circumstances, lenders will either want the client to be a homeowner, a landlord or achieve a minimum income. Most lenders will not require the client to own an existing Holiday Let.

Are there tax advantages to owning a Holiday Let?

If this is set up as a Furnished Holiday Let (FHL) it can provide the owner with certain tax advantages over a standard BTL property. There are certain requirements a Holiday Let property needs to meet to be classified as a FHL, specific to availability, bookings and level of furnishings.

How do lenders look at affordability?

They broadly sit in two camps – Some lenders simply rely on the valuer to provide as standard AST rental income, as with BTL lending.

Other lenders will look at the actual holiday rental income of the Holiday Let property. Typically a lender will take an average 30 week occupancy split between low, mid and high season.

What about types of property & other important aspects?

Like any BTL enquiry you need to establish where the property is situated, how many bedrooms and if a MUB. Most lenders are happy with up to 6 bedrooms. Some Holiday Let properties may carry restrictions, such as it cannot be used as residential. If this is the case please highlight from the outset as it will influence which lender we approach.

As with many specialist loans, there are a great number of options available through our panel of lenders. The team at Complete FS are ready to help you place your case successfully, you can call us on 023 8045 6999 option 2.

TMA UPCOMING EVENTS

Technology HiiT Session: featuring Eligible, iPipeline & Experian

Friday 6th August, 10:00am – 11:00am

Compliance HiiT Session: Vulnerable Customers

Friday 13th August, 10:00am – 11:00am

Protection HiiT Series

Tuesday 21st September, 10:00am – 11:00am

CLICK HERE

QUERY OF THE WEEK

Q – Will any lenders accept agricultural properties with 50 acres of land and also accept additional benefits as income?

Please give our broker support desk a call on 0330 303 0236 for more information.

LATEST BLOGS AVAILABLE

Hodge

Did you know, Hodge can help your clients make the next years, the best years.

New Build Bulletin Launch

Welcome to the first issue of our New Build Bulletin!

Precise Mortgages

Helping broker’s take on adverse credit during adverse times

CLICK HERE