UPCOMING EVENTS

LATEST BLOG

QUERY OF THE WEEK

TMA Compliance Session HiiT

Friday 29th October at 10am

Virtual Workshop

Tuesday 9th October 2021

Platform

‘Know economic abuse’

By Brad Rhodes, Corporate Account Manager, Platform

Are there any lenders that will do a residential remortgage on a house with 10 acres of land and a place to moor boats next to the land? The property is also next door to a boat repair shop.

West One

NEW HOLIDAY LET EXCLUSIVES FOR TMA MEMBERS

We are delighted to inform you West One have provided TMA members with a brand-new range of exclusive Holiday Let products at 70% LTV.

Highlights:

- £1 million maximum loan

- 5 year fixed / 3 year ERC

- Faster completions and reduced legal fees for qualifying remortgages up to £750k

- First time landlords

- No credit scoring – underwriting based on credit assessment

- No additional interest rate loading for limited company applications

Products:

- 5 year fixed, rate 3.54%, max LTV 65%

- 5 year fixed, rate 3.74%, max LTV 70%

Their new exclusive Holiday Buy To Let product range, with first charge products also available as Consumer Buy to Let mortgages.

Contact details:

Email: btlbrokersupport@westoneloans.co.uk

Phone: 0333 1234556

www.westoneloans.co.uk

Exclusions apply.

Dispelling the myths of specialist buy to let

It’s the final week of myth busting specialist buy-to-let with West One and they have two final misconceptions to clear. Find out more and how to be in with a chance to win a luxury hamper here…

Myth #5

Variety of solutions as cases are considered on their own merit – Fact

High Street lenders have increasingly moved to a more automated solution, while this works perfectly for low risk and low loan to value loans, it cuts out the human interaction and can result in cases with a degree of complexity falling out.

A specialist lender that undertakes manual underwriting will be better placed to offer a solution for a variety of cases. At West One, our expert team of underwriters assess each case on its own merit, doing so quickly and efficiently.

Myth #6

An individual must earn over £25k to get a BTL mortgage – Fiction

Many mortgage lenders typically require a minimum income of £25,000 for prospective buy-to-let borrowers. Some specialist lenders may require less by way of minimum income and will decide based on the income being enough to cover their personal expenditure. However, at West One, we have no minimum income requirement.

West One are offering you the chance to enter their free prize draw to win a luxury hamper from Fortnum and Mason. Click here to enter: https://www.westoneloans.co.uk/dispelling-the-myths-of-specialist-buy-to-let-clubs-networks

Entries must be received by 5 pm on Friday 22nd October. We will be announcing the lucky winner on Monday 25th October!

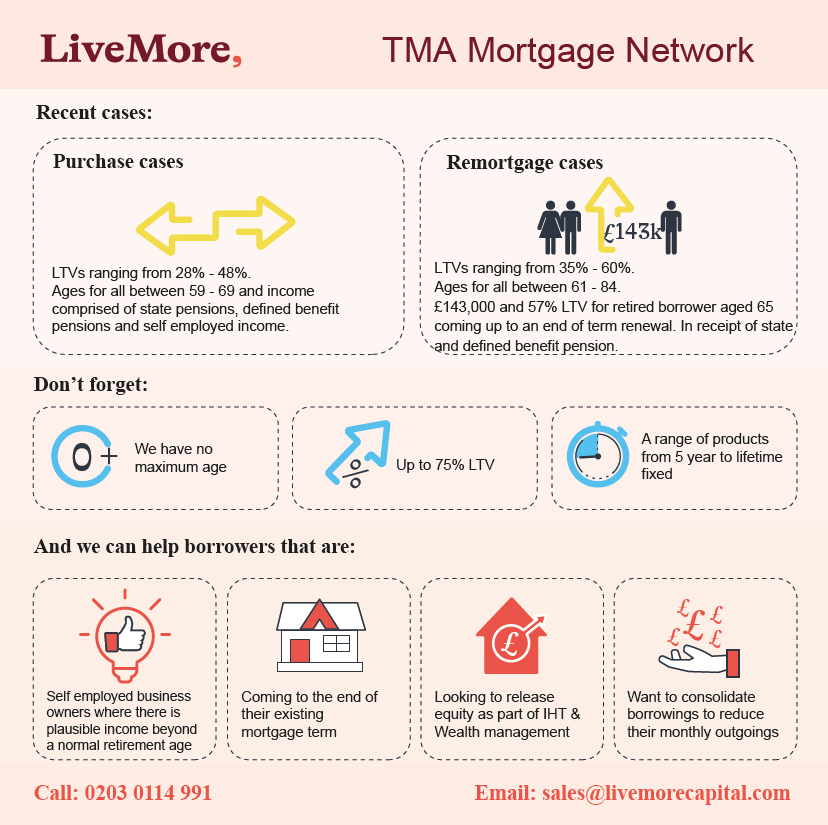

LiveMore

Recent purchase and Remortgage cases

We’ve had a fantastic quarter with TMA and we’re so pleased that we have been able to help your customers live their later life to the full.

Our market leading LTV of 75% has come into its own this quarter, with numerous cases ranging from 28% up to 48% for purchase cases and from 35% to 60% for remortgage cases.

By applying our common-sense approach to underwriting and looking at other factors beyond a borrowers age has meant that the average age of a TMA customer we’ve been able to lend to is 67, with one joint borrower being 84 and delighted that they now have the funds to be able to undertake their home improvements.

We have no maximum age, a range of products from 5 years to lifetime fixed and our revolutionary Ongoing Care Fee programme. This means we will pay 0.55% gross paid after completion, plus an additional 0.13% gross per year for up to 15 years. There really are a huge number of reasons to choose LiveMore!

If you have a case that you would like to discuss, then call the Sales Team now on 0203 0114 991 or register today here.

British Friendly

Introducing our new Occupation Guide

We have recently undertaken a review of our occupation list and we now offer cover to more occupations including pilots and fitness instructors.

Plus, to give you extra clarity on our stance and help you manage client expectations, we’ve created a brand new Occupation Guide which replaces our previous list of ‘excluded occupations’ in our Terms and Conditions and on our online application journey. Our new Occupation Guide can now be accessed through our Adviser Toolkit on our website advisers.britishfriendly.com.

View our new Occupation Guide here.

We’re also pleased to let you know that we’ve made a number of enhancements to our online journey to improve your overall experience when applying for our Income Protection cover on behalf of your clients.

Get in touch

Feel free to get in touch with our Partnership Support Team by e-mailing sales@britishfriendly.com or calling us on 01234 358 344 (option 1) and we’ll be happy to help with any queries

The Mortgage Lender

We all know bigger is better

Right now the booming buy-to-let market wants bigger, better loans.

Our new range of fixed-fee BTL products can stretch to a whopping £3m, with a fixed completion fee of just £2,495, so they’re fantastic value for larger loans. Individuals, limited companies and LLPs can apply, whether for purchase or remortgage.

- Maximum £1.5m to 75% LTV, £3m to 70%

- Affordability from 125% at pay rate

- No minimum income.

- No limit on portfolio with other lenders

What’s more, you can now deal directly with our underwriters once your application is submitted. You’ll also have a dedicated Business Development Manager, plus a Tele BDM to support your enquiry and package the case.

We’ll help your clients go large, for a remarkably small fixed fee.

Just

Winners of Just Group vulnerable customer awards announced

We’re delighted to announce the winners of the Just Group 2021 Vulnerable Customer Awards scheme dedicated to recognising and showcasing financial advice firms, and individuals, for their achievements in customer vulnerability.

The judges were thrilled with the quantity and quality of entries from firms of all sizes.

Zephyr Homeloans

Back on the road helping brokers

Our Regional Sales Managers Elliot, Andy and Mark have been out and about meeting brokers in their offices and attending several events over the last few weeks.

We’ve had some great conversations with brokers with positive feedback about our products, service and criteria. So, if you’ve got a BTL case on your desk, here are some great reasons why you should give Zephyr a try:

- Single properties & large portfolios accepted

- Max loans to £2m

- £0 application fees & 0% product fee options*

- Up to 80% LTV

- Standard & Specialist properties – HMOs, MUFBs, FACs, New Builds

- Individuals & Limited Companies (SPVs)

- Personal & Portfolio income backed Top Slicing considered**

- Consistent and reliable service

* Other fees and costs apply. ** Subject to criteria.

You can see details of some recent cases we’ve supported below, together with a testimonial from a happy broker! We’ve also included a calendar of upcoming events, so you know where to find us.

If you can’t catch us in person this autumn just give our expert team a call.

Cases we’ve recently supported

- Two brothers, one a first-time landlord and a first-time buyer, moving a MUFB property in to a new SPV, then remortgaging next-day to raise cash to fund a property purchase on the same street – we accept new Ltd Co (SPV) applications from related Directors and allow remortgaging for capital raising purposes.

- Client purchasing the flat above his own main residence – we’re able to consider BTL properties within close proximity of other owned BTLs or the applicant’s residential home.

Mansfield Building Society

Case Study: enabling a landlord expand their portfolio despite reduced rental income

At the Mansfield Building Society, our common sense approach can allow us to be flexible and support brokers and their clients to make the most of their investment opportunities.

In this recent buy to let application on our 5 year fixed rate, where rental income is stressed at pay rate, a portfolio landlord wanted to remortgage with capital raising to purchase another investment property.

The landlord was charging £1,100 in rent to the tenant, which fell outside our standard product stress test but was acceptable when we stressed it at the product pay rate:

- Property Value: £290,000

- Loan Amount £217,500

- LTV: 75%

- Rental income required if stressed at 5.5%: £1246.08

- Rental Income required if stressed at 3.39%: £768.08

Whilst the landlord also had a background BTL property which did fit our standard requirements, the applicant wasn’t in a position to increase the rent on this property and therefore our 5 year fixed rate product worked perfectly – for the landlord and the existing tenants.

If you have any buy to let landlords as clients, looking to purchase or remortgage and facing obstacles with limited rental income, our five year fixed rate could really help – whether it’s purchase, remortgage or even to raise funds to purchase another property.

Visit mansfieldbs.co.uk/intermediaries or call our broker support team on 01623 676360 to find out more.

Legal & General

New ‘State of The Nation’ report: Uncovering the risks to small & medium sized businesses

Did you know that 59% of businesses would cease trading within 12 months of losing a key person.

Our report gathers insights from small and medium size businesses about the potential risks they may face, their awareness of risks, and how they as a business could mitigate them.

What’s inside the report?

Our 7th edition State of the Nation Report includes:

- The impact of Covid-19– impact, outstanding debts and recovery

- Helping businesses mitigate risks– exploring awareness to known and unknown risks

- Value of advice–helping you have the protection conversation with your business clients

Newbury Building Society

90% LTV lending is back for standard residential mortgages

Available now on our 3 year discount and 3 year fixed until 29 November 2024 mortgage products.

Also… our ExPat BTL LTV limit has increased to 75% LTV.

OTHER REASONS TO CHOOSE US:

- Instant chat service for rapid responses

- No credit scoring – all cases are assessed on individual merit

- You have a dedicated BDM who can help you on an individual basis.

- For further information, or to arrange a visit from a BDM contact us.

*For residential mortgages including Shared Ownership, Shared Equity and Help to Buy we lend anywhere in England and Wales. For the following London and surrounding area postcodes the maximum LTV is 60%: CR, E, EC, EN, HA, IG, KT, N, NW, RM, SE, SM, SW, TW, UB ,W and WC.

Central Trust

The alternative to a remortgage when capital raising

Have you found of late that you are recommending more fixed rate deals? It’s not surprising with the BOE rate at a record low of 0.1%, mortgage rates are hugely competitive.

Self-employed and contractor clients

Have you found it more difficult to refinance clients that are self-employed or contractors? Limited government support and tightening of main stream lending criteria, has left many struggling to evidence their affordability, which would explain the uplift in product switches.

Fixed rates mortgages shouldn’t prevent the ability to capital raise

A fixed mortgage payment provides security and peace of mind. But, it can make additional capital raising harder. Especially if a further advance is not granted by the lender, or where a remortgage might be costly if there is an early repayment charge.

The number one priority of any mortgage advisor is to support their clients. So when faced with a capital raising scenario where the client maybe on a preferential rate, tied into an ERC, declined for a further advance, or would switch an interest only facility to a repayment, a more holistic view of the market might be needed.

A second charge mortgage could be the ideal solution. It’s a viable alternative to a re-mortgage and a good customer outcome in the short term when customers:

- Look to conduct large scale home improvements

- Wish to consolidate their debt

- Want to repair and rebuild their credit

- Have a lower than average credit score

- Fall short of loan to income multiples

- Are self-employed for as little as 12 months

In 2016, second charges became regulated mortgage contacts, which saw 1st and 2nd charge mortgages aligned entirely. Despite that, the perception for many is that the product is specialist, and in turn for some prevents the product from being a consideration. This has left many customers underserved and researching solo for a solution, the need to capital raise doesn’t fall away, but by not considering the product ancillary sales might be put at risk.

This doesn’t need to be the case. At Central Trust we are experts in the specialist mortgage market. We will work with you to find the right customer outcome, with a guarantee of no cross sell. The customer is and always will be yours. We are happy to advise and package, or just package.

By recognising the opportunity you protect your client bank.

Santander for Intermediaries

Why choose Santander for Buy to Let?

4.00% Buy to Let affordability rate

(available on remortgages without capital raising on all products and purchase or remortgages with capital raising on five year fixed products only).

It’s easy to add an additional Buy to Let property in Introducer Internet by clicking our additional Buy to Let property tab in ‘My applications’. This will allow you to copy the details of a Buy to Let FMA to another.

If at least one applicant’s income tax band is 20% or less, we’ll use a lower rental cover of 130% (income tax band must take into account profit on rental income for all properties that the applicant will own on completion).

Teachers for Intermediaries

Buy now, sell later – to break the chain

When an adviser told us their client needed to secure the purchase of a new home before selling their existing property to give their children access to the right school we had the perfect solution:

An ERC free short-term mortgage…

THE CASE

Moving to benefit from a different school catchment area that offered the right education for their children, the clients risked losing their ideal home after failing to secure a buyer for their existing property. They needed a fast and flexible solution to be able to buy now and sell later.

THE PROPERTIES

Their existing home is a five bed semi in Greenwich valued at £1.75m; the new home is a six bedroom Victorian semi valued at £2.6m, in Dulwich.

THE FINANCIAL DETAIL

The applicants had a substantial combined income from their city jobs as a barrister and lawyer respectively. However, one of the clients had recently been promoted from employee to self employed salaried partner with less than 12 months tax calculations as evidence of earnings available.

Their current home has around £1.5m of equity plus they own a buy to let property which has around £600k equity. Other assets included savings, a substantial inheritance, pensions and income from their rental property.

THE SOLUTION

To break the property chain we agreed a part interest only part repayment solution providing two short term ERC free mortgages on both the new and current properties.

Despite a recent change in employment status, long standing tenure within the same firm gave us confidence in the client’s salary expectations. We combined this income with potential drawdown created through the monetisation of assets, which together met affordability requirements for both mortgages.

Once a buyer was found, the client planned to use equity in the former home to fully repay the outstanding mortgage (of just under £250k) and use the additional equity against the new property to reduce the required long term single mortgage.

THE OUTCOME

By working closely with the adviser we were able to agree the case quickly, ensuring the client had the keys to their new home and was moved in before the start of the new academic school year.

Do your clients need to purchase before selling? Just ask us at TFI…

Call 0800378669